What is the Willie Sutton Rule?

The Willie Sutton Rule is based on a statement by notorious American bank robber Willie Sutton, who when asked by a reporter about why he stole from banks, answered: “Because that’s where the money is.”

In other words, his end goal was money so why should he waste time looking for it in obscure or questionable places instead of taking the path of least resistance and most success and going straight to the source?

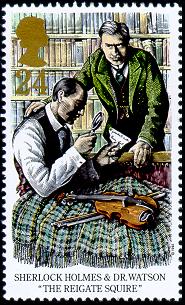

Some historians explain the Willie Sutton Rule by way of Arthur Conan Doyle’s famous detective, Sherlock Holmes, who once said, “When you have eliminated the impossible, whatever remains, however improbable, must be the truth.” Both quotes mean the same; they just drew conclusions coming from opposite directions.

The rule can be applied across many different disciplines: medicine, science, business and accounting are a few examples.

In medicine, it is referred to when doctors make a diagnosis, suggesting that it is worthwhile to first focus on the obvious and conduct medical tests that may confirm the most likely diagnosis, rather than trying to diagnose a relatively uncommon medical condition. This approach may yield faster and more accurate results, while avoiding needless costs that would be incurred by conducting unnecessary medical tests.

The same goes for accounting. The rule with respect to management accounting says that activity-based costing (prioritising by necessity and budgeting accordingly) should be applied to the highest costs because that will ultimately be where the largest savings are incurred.

In the financial world, the rule is similar to, “picking the low-hanging fruit.” In other words, if you’re looking to make money in the stock market, start by choosing those positions that you can see clearly for what they are. They may not be the biggest pieces of fruit, but at least you know what you’re getting. Only after seeking out the more obvious choices should you venture further into the tree and pick something that may be rotten or never develop fully.

Another school of thought with respect to investing that the Willie Sutton Rule stresses is the need for an individual to focus on activities that generate high returns, rather than on actions that might be frivolous or yield lower returns.

The Willie Sutton Rule is often taught to medical students as Sutton’s Law. It states that when making a diagnosis, it is worthwhile to first focus on the obvious and conduct medical tests that may confirm the most likely diagnosis, rather than trying to diagnose a relatively uncommon medical condition. This approach may yield faster and more accurate results, while avoiding needless costs that would be incurred by conducting unnecessary medical tests.

https://www.investopedia.com/terms/w/willie-sutton-rule.asp

William Francis Sutton Jr. (1901-1980) was an American bank robber. During his forty-year career in robbery, he stole an estimated $2 million, and he eventually spent more than half of his adult life in prison and escaped three times. Sutton is known as the namesake of the so-called Sutton’s Rule, although he denied originating it.

Image of British postage stamp (1993) on Sherlock Holmes and Dr. Watson courtesy: https://crossexaminingcrime.wordpress.com/